- My company is not established in the EU. Should I really worry about the EU Data Act applying to my company?

- What are the operational impacts of the EU Data Act on my products‘ interface?

- My products are already on the market, can I still provide them as I am today?

- What data is in the EU Data Act scope?

- Does the EU Data Act provide for a harmonized framework for blockchain-based smart contracts?

- Who can request the sharing of data?

- How should data be made available?

- Are there any limitations on how the data can be shared?

- Can I invoke intellectual property right to forego the data sharing?

- Should the data be made available to public entities as well?

- Will I need to update my contracts as well?

- Will the data be required to stay in the European Union?

- When will all this become an operational reality for me?

- What are the EU Data Act penalties?

14 Questions about the EU Data Act

August 27th, 2024 | Posted by in Artificial Intelligence | Blockchain | Europe | IT | Legislation - (0 Comments)French Parliament Takes Steps to Regulate NFT Games

October 31st, 2023 | Posted by in Blockchain | France | Intellectual Property | IT | Legislation | Non classé - (0 Comments)On 18 October 2023, the French National Assembly voted in favour of a law aiming to secure and regulate the digital space (“Loi visant visant à sécuriser et réguler l’espace numérique” or “SREN”), otherwise called the “Sorare Act.” This new development marks a first step towards the establishment of a regulatory framework dedicated to games integrating non-fungible tokens (NFTs) and monetisation models based on digital assets.

These new provisions are aimed at the creation of a new category of games under French law called games with monetisable digital objects (“jeux à objets numériques monétisables” or “JONUM”). This new regime will enter into force ‘on an experimental basis and for a period of three years’ from the promulgation of the law and will authorise Web3 games with monetisable digital objects (including NFTs).

The Sorare Act defines JONUMs as “game elements, which only confer on players one or more rights associated with the game, and which may be transferred, directly or indirectly, for consideration to third parties,” while excluding digital assets covered by 2° of Article L. 54-10-1 of the French Monetary and Financial Code.

France is one the first jurisdictions in the world to create a specific regime for companies using NFTs as part of their games and the objective is to provide certainty to the industry.

Please reach out to our team if you need further information on this new development.

First publication: K&L Gates Hub, in collaboration with Lucas Nicolet-Serra

The New Digital Frontiers: How IP is adapting to virtual worlds, from NFTs to virtual products

August 24th, 2022 | Posted by in Blockchain | Intellectual Property | Trademarks - (0 Comments)Virtual products, the metaverse, and non-fungible tokens (NFTs) have recently been expanding and receiving considerable attention from investors, the general public; as well as the art world – within the span of a year, NFT-backed virtual works of art have been reaching new height, from Beeple, Everydays: The First 5000 Days (March 2021 – US$ 69.3) to The Merge (December 2021 – US$ 91.8). Today, the most valuable living artist in history is a virtual work of art author (Pak, author of The Merge).

With the rise of this new market, numerous stakeholders have tried to expand the protection of these digital creations through trademark registration before the European Union Intellectual Property Office (EUIPO) or its national counterparts in the European Union. However, they also found that the current 11th Nice Classification lacked clarity and precision on that matter. Indeed, the “virtual goods” may represent an electronic version of an existing tangible goods, but the applicants were likely to face rejection from the trademark offices, as the classification as a “good” still requires a physical embodiment.

In June 2022, the EUIPO finally addressed this issue to provide clarity, by going on the record to consider virtual products (including NFTs, or more likely the underlying virtual works to which such NFTs would be appended) as digital content or images, hence belonging to Class 9 which encompasses instruments for science or research, audio-visual and information technology equipment, as well as security and safety equipment. This new approach is part of its 2023 draft Guidelines which aims at harmonising IP practices across the EUIPO, increasing predictability and ensuring compliance, consistency and coherence.

Consequently, virtual goods and NFTs will be added to the upcoming 12th edition of the Nice Classification. However, the EUIPO rightfully considers NFTs to be certificates, distinct from the virtual element they authenticate. A specific wording has been established in the draft directive, namely “downloadable digital files authenticated by non-fungible token”, the term “non-fungible token” being deemed, in and of itself, not acceptable by EUIPO without a proper link to the underlying asset.

The EUIPO is not going to further modify this Class to address all possible situation, but advises applicants to specify which content the virtual products are referring to, e.g.“downloadable virtual products, namely virtual pieces of furniture.”

Concerning virtual services and NFTs, the actual principles are maintained and applicants need to refer to pre-established definitions.

This decision from EUIPO allows for the facilitation of virtual products and NFTs trademarks. Internal and external stakeholders have until 3 October 2022 to escalate observations on draft directives to the EUIPO.

First publication on the K&L Gates IP Blog in collaboration with Louise Bégué

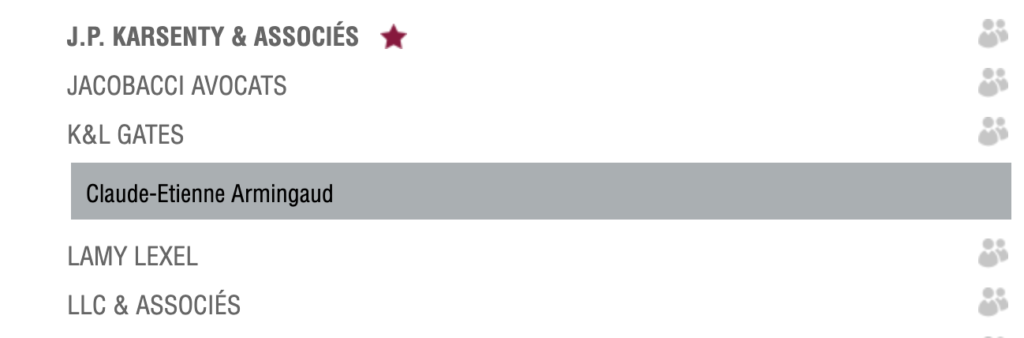

Legal 500 Rankings 2020 – Industry focus: IT, telecoms and the internet – Band 4

May 21st, 2020 | Posted by in Blockchain | Connected Cars | eCommerce | France | IT | Rankings | Software | Trusted Services and eSignature - (0 Comments)Practice head(s):Claude-Etienne Armingaud

Testimonials

‘The team is well versed and up to date on the current standards and practices. Team members are all very flexible in their availability and very responsive’.

‘The team provides sharp advices and has great sector industry knowledge’.

‘The team has in-depth expertise and great ability to anticipate future legislation’

(more…)‘Claude Etienne Armingaud is more than a lawyer; he is a trusted partner who knows his own limits and is very friendly’.

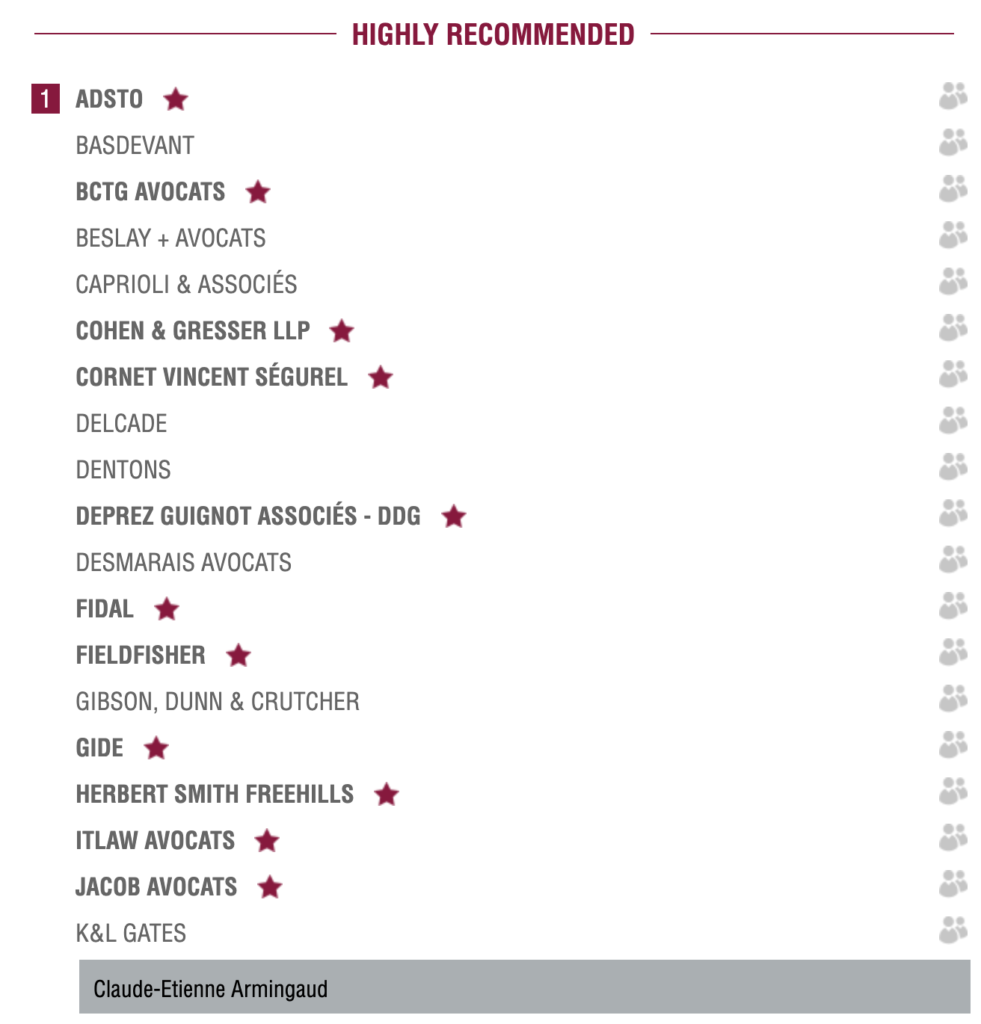

Leaders League Ranking 2020 – Technologies, internet & telecommunications – Data protection law – France

April 13th, 2020 | Posted by in Blockchain | Connected Cars | France | IT | Privacy | Software | Trusted Services and eSignature - (0 Comments)K&L Gates ranked “Highly Recommended – Band 1” with Claude-Etienne Armingaud.

Source: Leaders League

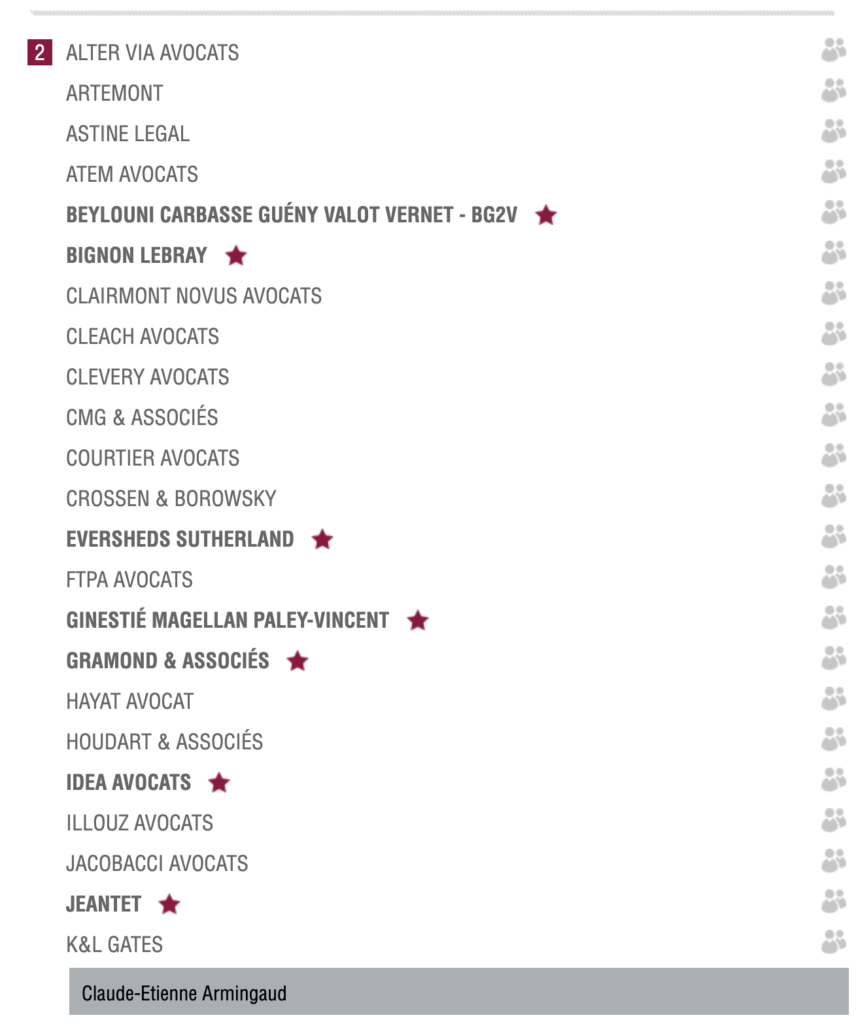

Leaders League Ranking 2020 – Technologies, internet & telecommunications – Internet – France

April 13th, 2020 | Posted by in Blockchain | Connected Cars | eCommerce | France | IT | Software | Trusted Services and eSignature - (0 Comments)Leaders League Ranking 2020 – Technologies, internet & telecommunications – IT law – France

April 13th, 2020 | Posted by in Blockchain | Communication | Connected Cars | eCommerce | France | IT | Software | Trusted Services and eSignature - (0 Comments)Italy: Legal Recognition of Blockchain-based Timestamping

June 1st, 2019 | Posted by in Blockchain | Europe | Trusted Services and eSignature - (0 Comments)Italian law no.12/19 dated 11 January 2019 (the “Law”) came into force on 13 February 2019 and cemented the legal enforceability of electronic timestamping performed through blockchain technologies.

(more…)Blockchain & Data Protection: Trustless Should Not Mean Distrusted!

November 8th, 2018 | Posted by in Blockchain | Europe | France | IT | Privacy - (0 Comments)Amidst the international tidal wave caused by the entry into force of the EU General Data Protection Regulation (“GDPR”) in May 2018, many half, or even false truths have been spread about hindrance on a global scale of innovative technologies. However, we must keep in mind that Europe has adopted a long-standing position of technology-neutral regulations and data protection is no exception.

Indeed, from a GDPR perspective, no technology would be prohibited or regulated by nature – only its application to a specific purpose may be regulated, inasmuch as it involves personal data -whether relating to the participants and miners or the payload data itself- and falls within its broad geographical scope (see our previous Alert for more details).

(more…)

AMF synthesis of the contributions received on Initial Coin Offering (ICO) regulation in France

February 28th, 2018 | Posted by in Blockchain | France | IT | Legislation | Trusted Services and eSignature - (0 Comments)The French Autorité des Marchés Financiers has recently published a synthesis of the contributions it received in response to its public consultation on Initial Coin Offerings (ICOs) to obtain stakeholder views on how these new types of blockchain offerings might be regulated.

The consultation included a presentation of ICOs, a warning on the risks they present, a legal analysis of ICOs with respect to the rules overseen by the AMF and the regulatory options proposed by the AMF. Respondents were invited to give their views on all of these points.

The English version of the synthesis can be found here, the French version here and our previous coverage of the consultation can be found here.

First published on K&L Gates Fintech Law Blog.